Last week, we had the opportunity to attend the MassMutual #FutureSmart event in downtown Phoenix. Over 3000 middle school children were invited to the Phoenix Suns’ Talking Stick Arena to learn all about how to plan for a successful future. The host for this event was actor Hill Harper! I didn’t know anyone could make planning for your future and learning about money so riveting (especially for 13-year-olds!), but Hill Harper definitely brings the excitement to these events!

Here are 3 things I learned at the event (and will be teaching to my own children).

1) Be open with the kids about your own finances. Most of us probably don’t talk much about our personal finances with our kids besides telling them they can’t have a new phone/toy/bicycle because it costs too much money. But, we should actually show our children how much money the family is bringing in each month, how much is allocated to food, housing, loans, and savings. I never really thought about it before, but how do we expect our children to grow up and run their own households successfully without any insight into how their own houses were managed when they were growing up? Maybe I can save my own children from making financial mistakes in the future by sharing with them today.

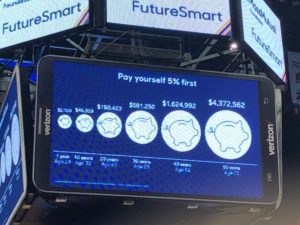

2) The Power of savings. Saving even a small amount, now, of each allowance, monetary gift, and money earned will grow exponentially and can literally change their life when they become an adult. Wouldn’t we all love to see our children grow up and be able to follow their passions, whether it is opening their own business or attending their dream college? There are so many more options for the future when finances are less of a road block. Have your children open a free savings account now to save a certain percentage for their future.

2) The Power of savings. Saving even a small amount, now, of each allowance, monetary gift, and money earned will grow exponentially and can literally change their life when they become an adult. Wouldn’t we all love to see our children grow up and be able to follow their passions, whether it is opening their own business or attending their dream college? There are so many more options for the future when finances are less of a road block. Have your children open a free savings account now to save a certain percentage for their future.

3) Delaying Gratification. When you do need to make a big purchase like a new computer or even the new pair of fancy shoes, save up the money before making that big purchase versus buying on credit. Not only will the purchase become that much more meaningful because you waited to make that purchase, but you are saving money by not having to pay the interest. Plus there is something valuable in really taking the time to plan and save for something. These are lessons we all need to learn throughout our life.

Even if none of us (or very few of us) feel like experts when it comes to managing our household finances and being smart about money, we do have valuable lessons to share with our children. And we should be open with them about mistakes we have made and lessons learned.

To learn more about the FutureSmart program with MassMutual and how you can get the program into your children’s school, follow the link.

Thank you to MassMutual, Hill Harper, and the Phoenix Suns for hosting us for the day and letting us attend this amazing event. We had a blast.

Thank you to MassMutual, Hill Harper, and the Phoenix Suns for hosting us for the day and letting us attend this amazing event. We had a blast.

This article was sponsored by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111-0001. www.massmutual.com All opinions are those of the author.

You can also read about Jennifer’s story about money here.